TL;DR

Open banking payments providers like Yapily enable businesses to process instant, cost-effective transactions directly from bank accounts, bypassing traditional intermediaries and enhancing security.

Yapily offers a suite of services including instant payments, recurring payments, and bulk payments, helping businesses streamline operations and reduce costs.

Ivy is a powerful alternative to Yapily, offering high conversion rates and enhanced security with SCA-compliant Open Banking payments. Its smart routing technology ensures optimal transaction processing, while instant payments, flexible recurring payments, and real-time payouts help businesses save on fees and improve customer experience.

Alternatives to Yapily include providers like TrueLayer, Trustly, GoCardless, and Tink, each offering robust solutions for open banking payments with features such as instant bank transfers and enhanced compliance tools.

As digital payments evolve, businesses and consumers are increasingly looking for seamless, cardless transaction solutions. In this guide, we’ll explore Yapily, an open banking payments provider, its features, fees, and the best Yapily alternatives to consider in 2025.

What is Yapily?

Yapily is an open banking platform that connects businesses to over 2,000 banks across Europe through its API. Yapily’s instant bank payments allow customers to make payments directly from their bank accounts, bypassing expensive intermediaries like credit cards and digital wallets, and saving businesses money on every transaction.

Yapily Features

Yapily has a comprehensive open banking payments platform with the following features:

Instant Payments: Instant account-to-account payments between customer and merchant bank accounts, settling within seconds.

Variable Recurring Payments: Maximize recurring revenue and eliminate manual data entry.

Bulk Payments: Streamline bulk payments and refunds to save time.

Customer Data: Businesses can access real-time customer insights using open banking data.

Yapily Connect: FCA-registered entity of Yapily, providing businesses with seamless, fast access to open banking data and payments without the requirement for a Third-Party Provider (TPP) license.

Yapily Fees

Yapily’s plans and fees are customized depending on the use case. Get in touch with them for more information.

Best Yapily Alternatives in 2025

Although Yapily is a well-known open banking payments provider, there are several alternatives available. Below, we highlight some of the top options.

Ivy

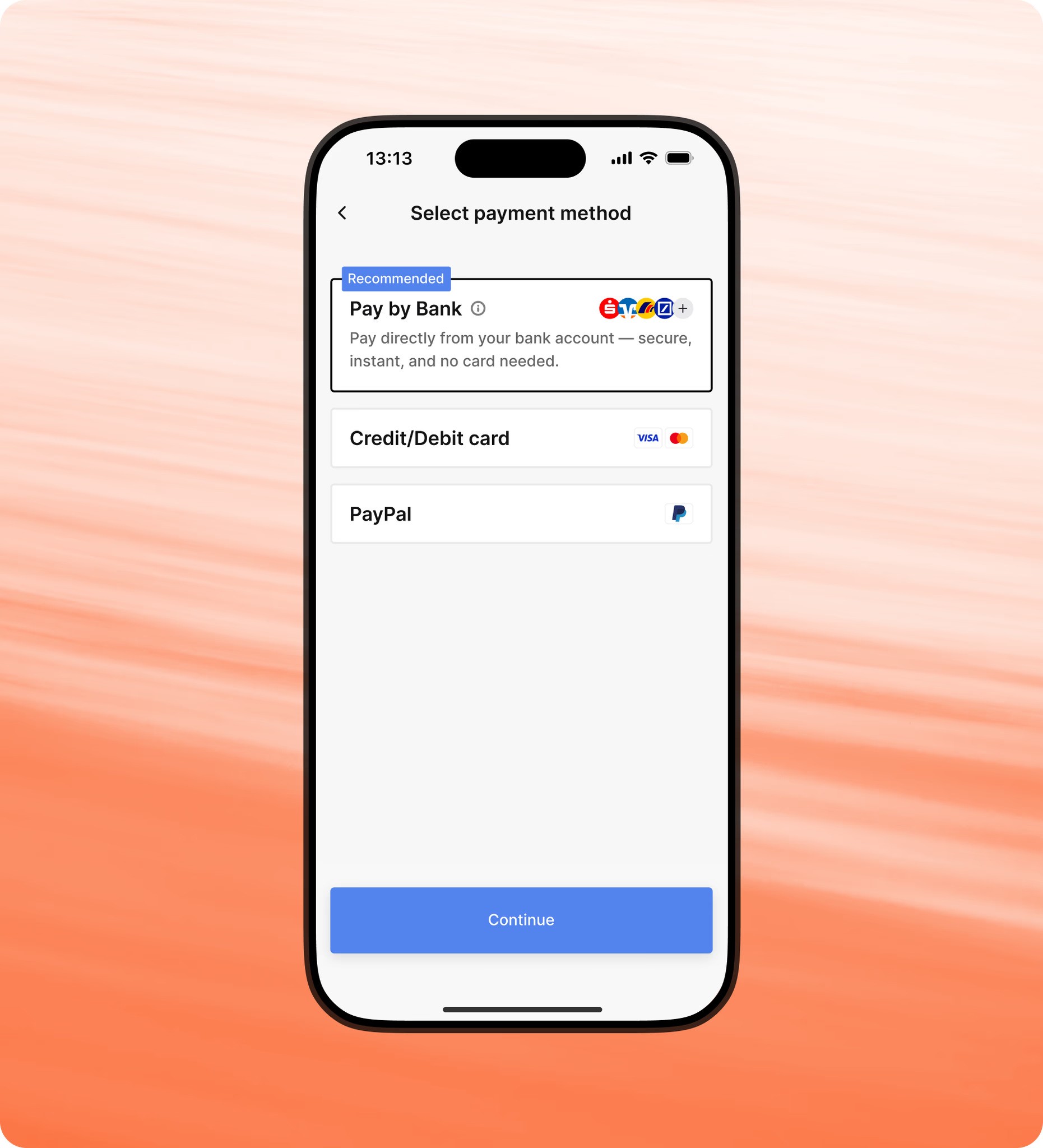

Ivy is redefining digital payments with its Open Banking-based solutions that cater to businesses of all sizes. With a focus on instant transactions, lower fees, and security, Ivy is a great alternative to traditional card and wallet-based payment methods.

Benefits

Coverage Champion: Ivy partners with top-tier local banks and Open Banking providers, ensuring businesses maximize their bank coverage.

Conversion Champion: With advanced smart routing technology, Ivy selects the best local Open Banking infrastructure for each transaction in real-time, achieving conversion rates of over 90%.

Enhanced User Experience: Returning customers benefit from pre-populated banking details, eliminating the need to select their bank repeatedly, thus streamlining the payment process.

Fraud Reduction: Ivy leverages Strong Customer Authentication (SCA)-compliant Open Banking payments to eliminate chargeback fraud.

Products

Instant Payments: Businesses can accept low-cost, real-time payments directly from customer bank accounts.

Recurring Payments: Ivy facilitates flexible, frictionless recurring transactions that are more secure than Direct Debit and cheaper than card payments.

Instant Payouts: Businesses can offer fast, reliable payouts to their customers with instant transaction processing.

Fees

Ivy offers custom pricing. Get in touch with us for more information here.

TrueLayer

TrueLayer is a UK-based open banking provider that allows businesses to accept instant bank payments. It connects with major banks across Europe, enabling users to initiate transactions smoothly. Merchants enjoy lower processing fees compared to traditional card payments. TrueLayer’s platform offers authentication and data-sharing services, ensuring compliance with open banking regulations for secure and transparent transactions for both businesses and customers.

TrueLayer’s offerings include instant payments, recurring payments, instant payouts, and access to open banking data and account verification.

Trustly

Trustly is an open banking payments provider that allows consumers to make online payments directly from their bank accounts, bypassing traditional and costly intermediaries like credit cards and digital wallets. With over 12,000 banks in its network, Trustly serves users across 33 countries.

Trustly offers a comprehensive open banking payments platform with a range of features, including instant payments that settle in seconds, enabling direct account-to-account transactions between merchants and users. It also supports instant deposits, boosting conversion rates and reducing friction, while businesses can transfer payouts to customers instantly in any European currency. Trustly enhances KYC and compliance by connecting customer data to each transaction and offers recurring payment solutions with Direct Debit mandates to reduce manual entry and payment failures.

GoCardless

GoCardless is a payment platform that allows individuals to make payments directly from their bank accounts, eliminating intermediaries like credit cards and digital wallets. It helps businesses automate payment collections, saving both time and money.

GoCardless offers a range of services, including recurring payment collection through Direct Debit, international payments, open banking payments such as one-off payments and VRP (variable recurring payments), as well as payer verification using open banking.

Tink

Tink is an open banking platform offering payment and financial data solutions. Connecting with over 6,000 banks across Europe, it allows businesses to access real-time financial data and initiate direct bank payments. Tink’s payment solution ensures quicker and more secure transactions, reducing the dependence on traditional card networks.

Tink’s product suite includes instant bank payments, VRP, payouts, and risk management. It also provides open banking data, such as transaction histories and liabilities, account verification, risk insights, and financial management tools.

FAQs

What is Yapily Connect?

Yapily Connect is Yapily’s FCA-registered entity that provides seamless access to open banking data and payments. It allows businesses to initiate transactions and retrieve financial data without the need for a Third-Party Provider (TPP) license, ensuring a simple and secure solution for integrating open banking services.

Is Yapily Connect Safe?

Yes, Yapily Connect is safe. It is fully compliant with open banking regulations and ensures secure transactions by leveraging advanced encryption and authentication methods. As an FCA-registered entity, it adheres to strict security standards, providing businesses and users with a reliable and secure platform for open banking services.

Additional Resources:

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Ivy GmbH or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.