TL;DR

Tink enables businesses to access user financial data and initiate payments with tools for account aggregation, risk decisioning, and finance management. It operates on a custom pricing model.

Ivy is a strong Tink alternative offering instant, secure, account-to-account payments. With smart routing, high conversion rates, and advanced fraud protection, Ivy is ideal for businesses seeking cost-effective and streamlined transactions.

Other top alternatives in 2025 include Yapily, which focuses on data access and compliance; Trustly, known for fast, direct payments across various industries; and GoCardless, which specializes in recurring payments using open banking.

As the landscape of digital payments progresses, both businesses and consumers are increasingly looking for quicker, more affordable payment methods that streamline the checkout process. In this guide, we’ll dive into Tink, an open banking platform, examining its key features, pricing structure, and the best Tink alternatives to consider in 2025.

What is Tink?

Tink is an open banking platform that enables businesses to access financial data and initiate payments directly from users' bank accounts. It provides tools for building financial services like payment initiation, account aggregation, and personal finance management.

Tink Features

Tink offers these features and products:

Payments: Including instant bank payments, variable recurring payments, instant payouts and risk signals that help protect businesses against fraud.

Account Data: Including instant account checks, transaction histories, pension and investment data, and balance checks.

Risk Decisioning: Including income checks, expense checks and risk insights.

Finance Management: Including data enrichment and merchant information.

Tink Pricing

Custom pricing. Get in touch with Tink for more information.

Best Tink Alternatives in 2025

Ivy

Ivy is transforming digital payments with its Open Banking-powered solutions, used by some of Europe’s biggest brands. With instant transactions, lower fees, and enhanced security, Ivy provides a powerful alternative to Tink.

Benefits

Coverage Champion: Ivy partners with top-tier local banks and Open Banking providers, ensuring businesses maximize their bank coverage.

Conversion Champion: With advanced smart routing technology, Ivy selects the best local Open Banking infrastructure for each transaction in real-time, achieving conversion rates of over 90%.

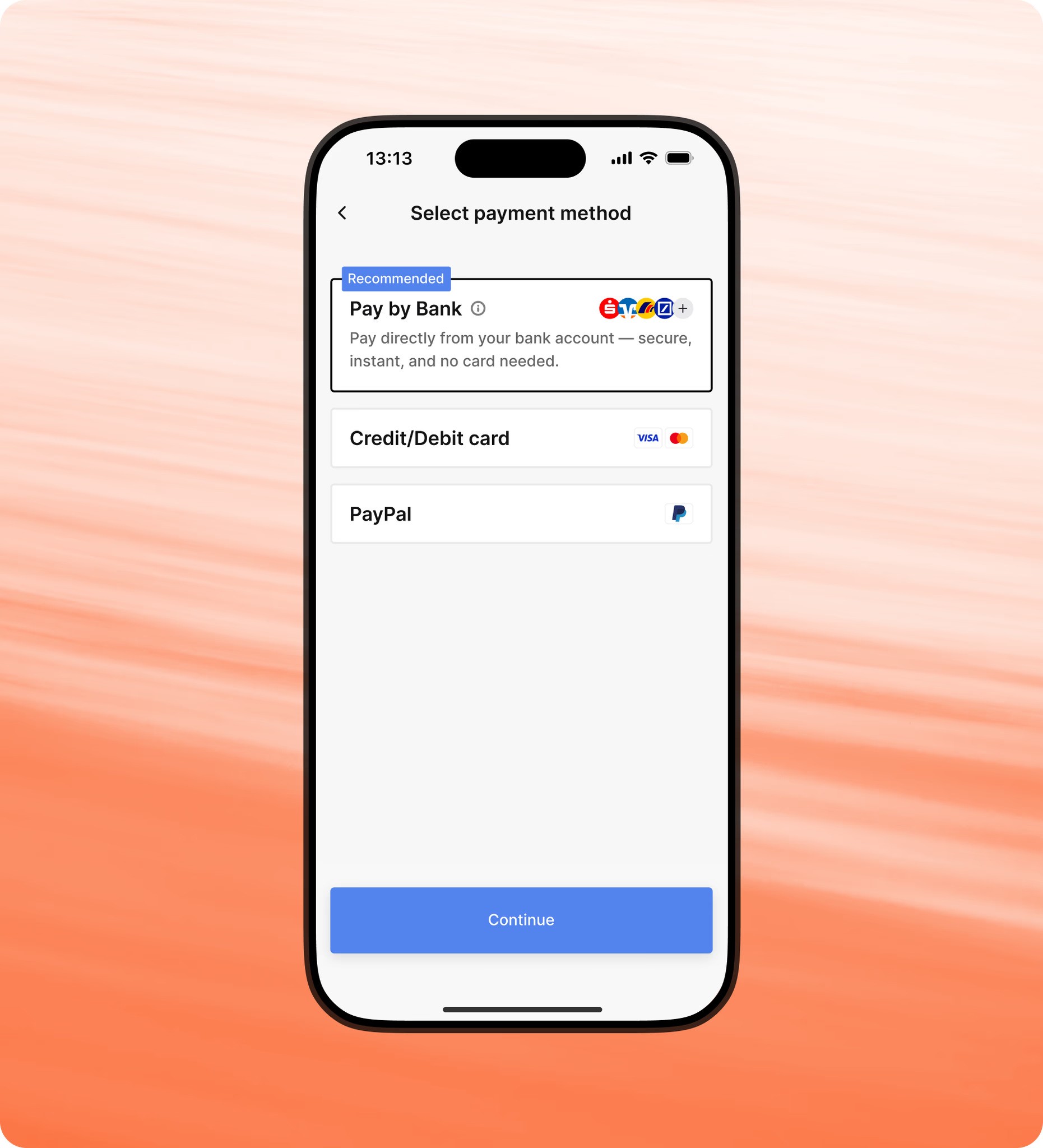

Enhanced User Experience: Returning customers benefit from pre-populated banking details, eliminating the need to select their bank repeatedly, thus streamlining the payment process.

Fraud Reduction: Ivy leverages Strong Customer Authentication (SCA)-compliant Open Banking payments to eliminate chargeback fraud.

Products

Instant Payments: Businesses can accept low-cost, real-time payments directly from customer bank accounts.

Recurring Payments: Ivy facilitates flexible, frictionless recurring transactions that are more secure than Direct Debit and cheaper than card payments.

Instant Payouts: Businesses can offer fast, reliable payouts to their customers with instant transaction processing.

Fees

Ivy offers custom pricing. Get in touch with us for more information here.

Yapily

Yapily is an open banking platform that connects businesses with bank accounts and financial data across Europe. It allows companies to access real-time, secure banking data and initiate payments directly from users' accounts. Yapily offers a range of services, including account aggregation, payment initiation, and data enrichment, empowering businesses to create innovative financial products and services. By enabling seamless integration with banks and financial institutions, Yapily helps businesses streamline financial operations, enhance customer experiences, and comply with regulatory requirements. Its platform simplifies the complexities of open banking, making it easier for companies to build cutting-edge financial solutions.

Trustly

Trustly is a global payments technology company that offers secure, instant, and direct bank payments. It enables businesses to process payments directly from customers' bank accounts, bypassing traditional card networks and intermediaries. Trustly’s platform supports online payments, bank transfers, and account verification, ensuring a seamless user experience. With a focus on security and speed, Trustly helps businesses reduce costs, increase conversion rates, and enhance customer satisfaction. The platform operates across various industries, including e-commerce, gaming, and travel, providing a reliable alternative to traditional payment methods and promoting frictionless transactions worldwide.

GoCardless

GoCardless is a payment processing platform that specializes in direct bank payments, offering businesses a simple and cost-effective way to collect recurring payments. The platform supports global payments and integrates easily with other financial systems, helping businesses manage payments efficiently. By leveraging open banking technology, GoCardless offers a secure and seamless payment experience for both merchants and customers, improving cash flow and customer retention across various industries.

TrueLayer

TrueLayer is an open banking platform that provides secure, direct access to financial data and payment initiation services. It enables businesses to integrate banking data into their products, allowing for better financial services such as account aggregation, payment processing, and identity verification. With a focus on security and ease of integration, TrueLayer helps businesses create innovative financial applications while complying with regulatory standards.

FAQs

What is Tink?

Tink is an open banking platform that provides businesses with access to financial data and payment initiation services. It enables companies to build innovative financial products by aggregating bank account data, simplifying payment processes, and enhancing user experiences.

Was Tink acquired by Visa?

Yes, Tink was acquired by Visa in 2021. Visa purchased Tink to enhance its open banking capabilities, expand its presence in Europe, and accelerate the development of new financial products. This acquisition helps Visa offer more innovative, secure, and seamless payment and financial services to its clients.

Is Tink safe?

Yes, Tink is safe. It complies with strict security standards and regulations, including GDPR and PSD2, ensuring secure access to financial data. Tink uses encryption and secure authentication protocols to protect users' sensitive information, making it a trusted platform for financial institutions and businesses in the open banking space.

Additional Resources:

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Ivy GmbH or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.