TL;DR

PayPal’s fees and limitations are driving both businesses and individuals to seek faster, more cost-effective payment alternatives. Flexibility and better international support are key motivators for switching.

Ivy, Stripe, and Wise Business are among the top PayPal alternatives in 2025, each offering unique benefits depending on business needs.

Ivy leverages Open Banking to enable instant, secure, account-to-account payments with lower fees and enhanced fraud protection.

Stripe is highly customizable, making it ideal for developers and e-commerce businesses, and it offers better international rates compared to PayPal.

Wise Business is designed for global transactions, offering low, transparent fees and real exchange rates for over 40 currencies.

PayPal alternatives are gaining popularity as businesses and consumers seek faster, more cost-effective, and flexible payment solutions. While PayPal remains a leading digital payment platform, its fees, policies, and limitations have led many to explore other options.

In this guide, we’ll provide an overview of PayPal, its key features, and how it works. Additionally, we’ll highlight the best PayPal alternatives in 2025, ranging from open banking solutions to other digital wallets and payment processors.

Whether you’re a business owner or an individual user, understanding these alternatives can help you find a payment solution that better suits your needs.

Best PayPal Alternatives in 2025

For businesses, choosing the right payment processor is crucial. While PayPal is widely used, it’s not always the best fit—especially for companies needing lower fees, better global transaction support, or more control over their payments.

In this section, we’ll explore the top PayPal alternatives specifically for business use. Whether you’re running an e-commerce store, handling international payments, or looking for seamless bank-to-bank transfers, these platforms offer tailored solutions to meet your needs.

The best PayPal alternatives for businesses in 2025 are:

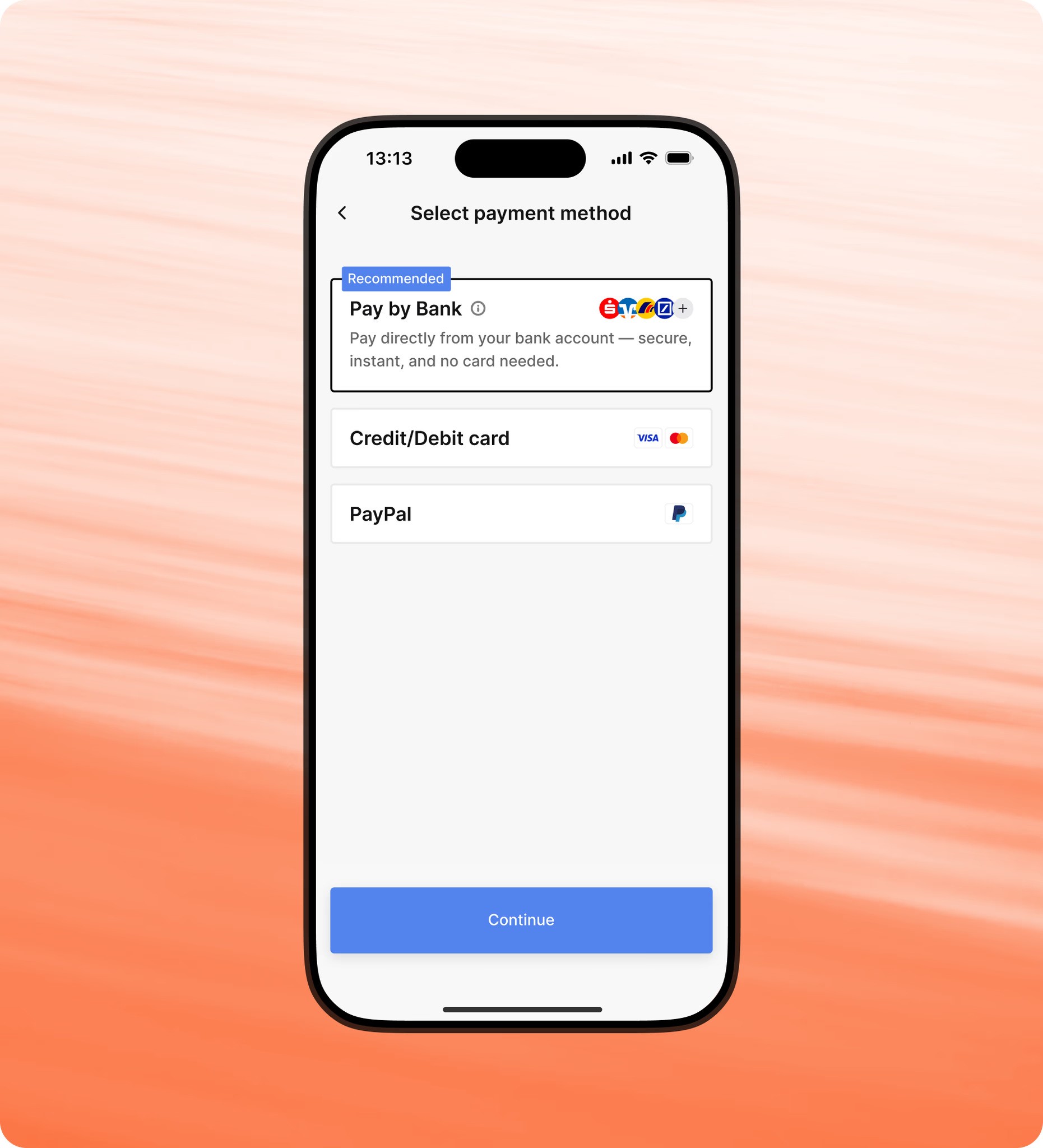

Ivy: The best open banking alternative, enabling direct account-to-account payments with low fees.

Stripe: Ideal for developers and e-commerce businesses needing advanced customization.

Wise Business: Best for international transactions with low currency conversion costs.

Each of these solutions provides distinct benefits depending on your business’s payment requirements.

Open Banking with Ivy

Ivy is transforming digital payments with its Open Banking-powered solutions, used by some of Europe’s biggest brands. With instant transactions, lower fees, and enhanced security, Ivy provides a powerful alternative to PalPal.

Benefits

Coverage Champion: Ivy partners with top-tier local banks and Open Banking providers, ensuring businesses maximize their bank coverage.

Conversion Champion: With advanced smart routing technology, Ivy selects the best local Open Banking infrastructure for each transaction in real-time, achieving conversion rates of over 90%.

Enhanced User Experience: Returning customers benefit from pre-populated banking details, eliminating the need to select their bank repeatedly, thus streamlining the payment process.

Fraud Reduction: Ivy leverages Strong Customer Authentication (SCA)-compliant Open Banking payments to eliminate chargeback fraud.

Products

Instant Payments: Businesses can accept low-cost, real-time payments directly from customer bank accounts.

Recurring Payments: Ivy facilitates flexible, frictionless recurring transactions that are more secure than Direct Debit and cheaper than card payments.

Instant Payouts: Businesses can offer fast, reliable payouts to their customers with instant transaction processing.

Fees

Ivy offers custom pricing. Get in touch with us for more information here.

Why Choose Open Banking?

Open banking offers a faster, more secure, and cost-effective alternative to traditional digital payment solutions like PayPal. Instead of relying on card networks and intermediaries, open banking enables direct bank-to-bank transactions, improving efficiency and reducing costs.

Here’s why open banking is gaining traction:

Lower Fees: Eliminates middlemen, reducing transaction costs.

Faster Payments: Real-time processing improves cash flow.

Enhanced Security: Bank-level authentication and PSD2 compliance reduce fraud risks.

Fewer Restrictions: Certain industries are restricted from using PayPal, making open banking a viable alternative.

Stripe

Stripe is a leading payment processing platform designed for online businesses. It allows companies to accept payments from customers worldwide, with support for credit and debit cards, bank transfers, and various digital wallets.

Stripe vs PayPal

PayPal | Stripe | |

Ease of use | Easy off-page checkout setup; more complicated for customizable gateways | More complicated to set up, since it must be integrated with your website |

Pricing | Charges variable % + fixed cost fees for different transactions. Additional fees for add-ons | Simple % + fixed cost fees, with additional charges for add-ons |

International Payments | Higher added fees for international transactions and currency conversions | Lower added fees for international transactions and currency conversions |

Customizability | Fully customizable checkout with additional fees | Fully customizable checkout at no extra cost |

Pay Later Options | Available natively with PayPal pay at no additional charge | Available natively with PayPal pay at no additional charge |

Currency and Transfer Types | Supports all major credit cards, 25 international currencies, Venmo transfers, crypto and ACH. | Supports all major credit cards, 135+ currencies, crypto and ACH debit and credit transfers. |

Source:

Zapier - Stripe vs PayPal

Wise Business

Wise Business (formerly TransferWise) is a global payment solution designed to help businesses manage international transactions efficiently. It allows companies to send and receive payments in multiple currencies with low, transparent fees and real exchange rates, making it an ideal choice for businesses with a global reach.

Wise vs PayPal

PayPal | Wise | |

Ease of use | Easy off-page checkout setup; more complicated for customizable gateways | Takes minutes to setup, but additional documentation may be required depending on where your business is located |

Pricing | Charges variable % + fixed cost fees for different transactions. Additional fees for add-ons | No subscriptions or monthly fees. % based or fixed fee depending on use case. |

Payment Processing | Instant card payments and up to 5 business days for bank transfers | Instant card payments and up to 2 business days for bank transfers |

Currency and Transfer Types | Supports all major credit cards, 25 international currencies, Venmo transfers, crypto and ACH. | Supports 140+ countries and 40+ currencies using the mid-market rate |

Sources:

Wise - Pricing

FAQs

What is the best PayPal alternative?

One of the best PayPal alternatives for businesses is Ivy, an open banking platform that enables direct account-to-account payments. It eliminates high fees and delays associated with traditional payment processors, with instant bank payments. Other PayPal alternatives include Stripe, Wise Business and Skrill.

How to set up a PayPal business account?

Setting up a PayPal business account is simple. Provide personal and business details, select your primary currency, and link a bank account. Choose a solution like PayPal Checkout or online invoicing. Access payment processing and tools anytime through the PayPal dashboard or mobile app to manage your account effectively.

When can I access funds on my PayPal business account?

You can access funds in your PayPal business account almost immediately after a payment is received. However, PayPal may place holds on funds for certain transactions, typically due to security or account activity. Funds are usually available within 1-2 business days, depending on your account and transaction type.

Additional Resources:

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Ivy GmbH or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional. We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.