Recurring Payments

Easy & Flexible Recurring Payments

Manage flexible recurring payments with low friction and high flexibility through Open Banking.

More secure than Direct Debit. Cheaper than cards.

Recurring Payments

Easy & Flexible Recurring Payments

Manage flexible recurring payments with low friction and high flexibility through Open Banking.

More secure than Direct Debit. Cheaper than cards.

Recurring Payments

Easy & Flexible Recurring Payments

Manage flexible recurring payments with low friction and high flexibility through Open Banking.

More secure than Direct Debit. Cheaper than cards.

Recurring Payments

Easy & Flexible Recurring Payments

Manage flexible recurring payments with low friction and high flexibility through Open Banking.

More secure than Direct Debit. Cheaper than cards.

Benefits of Ivy's Recurring Payments product…

Mitigate Payment Failures

Verification of bank accounts and elimination of manual data entry allows for a reliable and de-risked direct debit experience.

Boost Recurring Revenues

Intuitive UX, flexible use cases, and leading connectivity through smart routing deliver high conversion and maximum customer lifecycles.

Automate Management

A single API, intuitive dashboards, and high flexibility make managing recurring payments and mandates simple and cost-efficient.

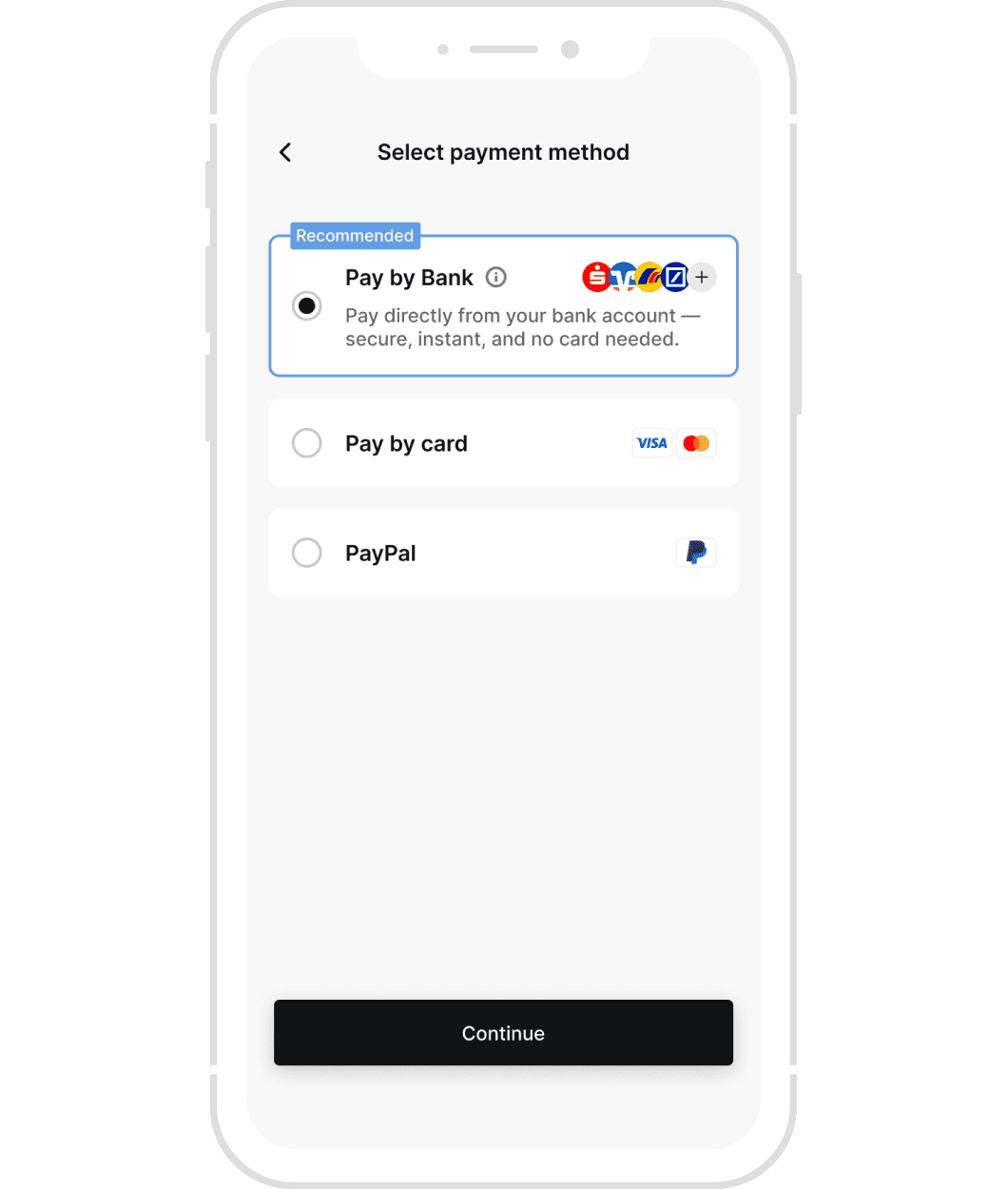

01.

Select 'Pay by Bank'

Choose Ivy’s "Pay by Bank" in checkout. Trusted local banks create confidence and drive conversion.

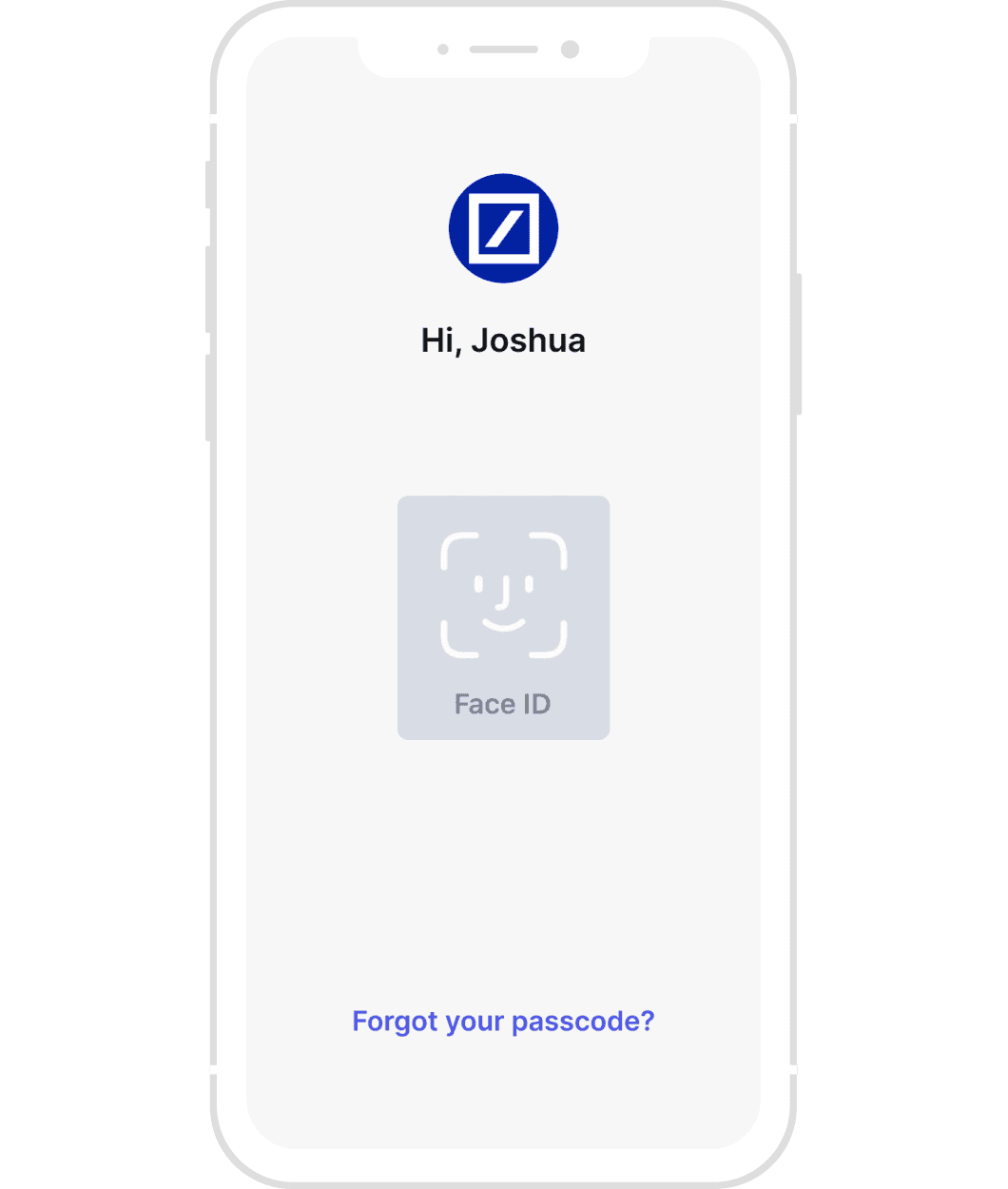

02.

Choose your bank

03.

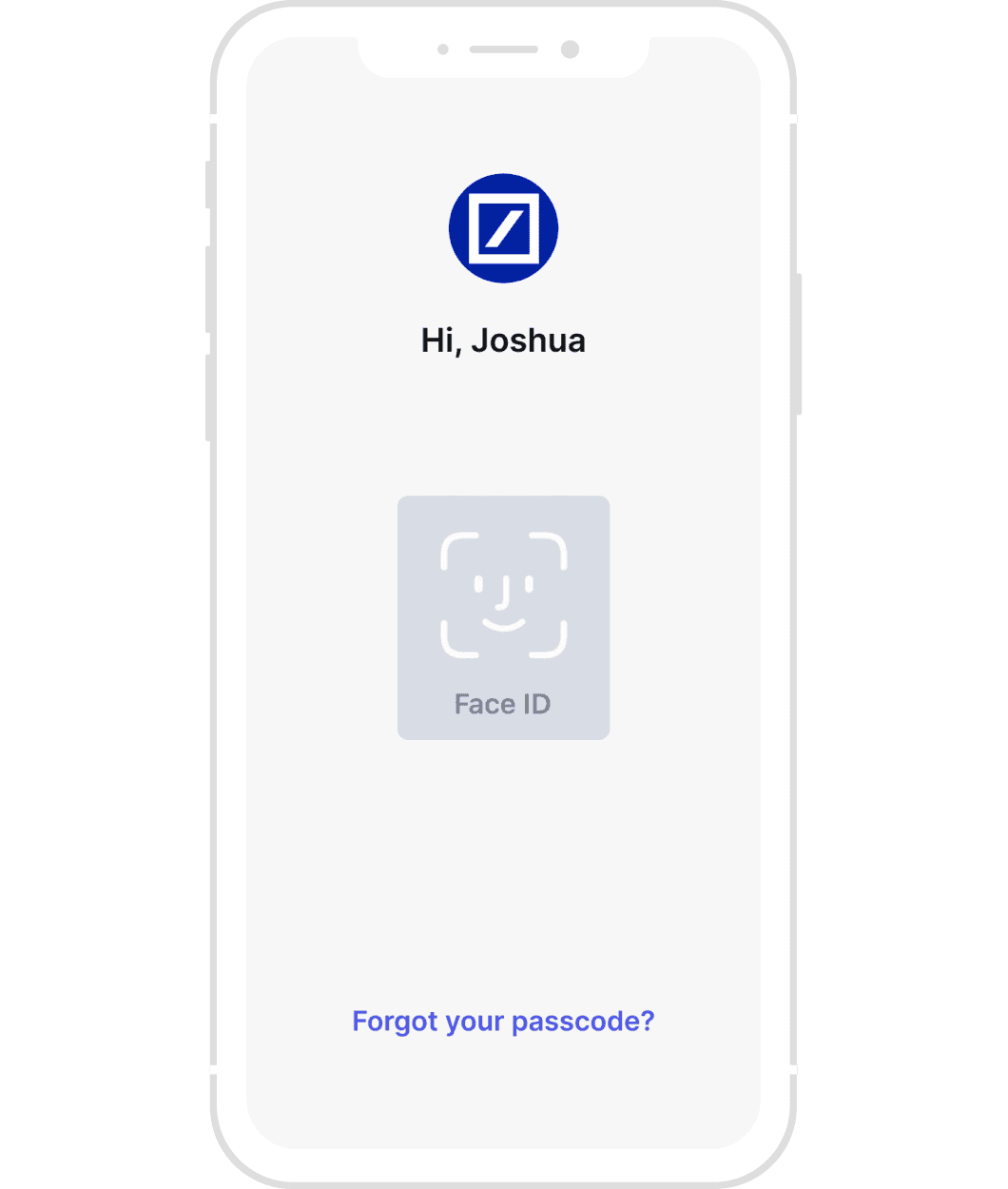

Authorise payment & direct debit mandate

04.

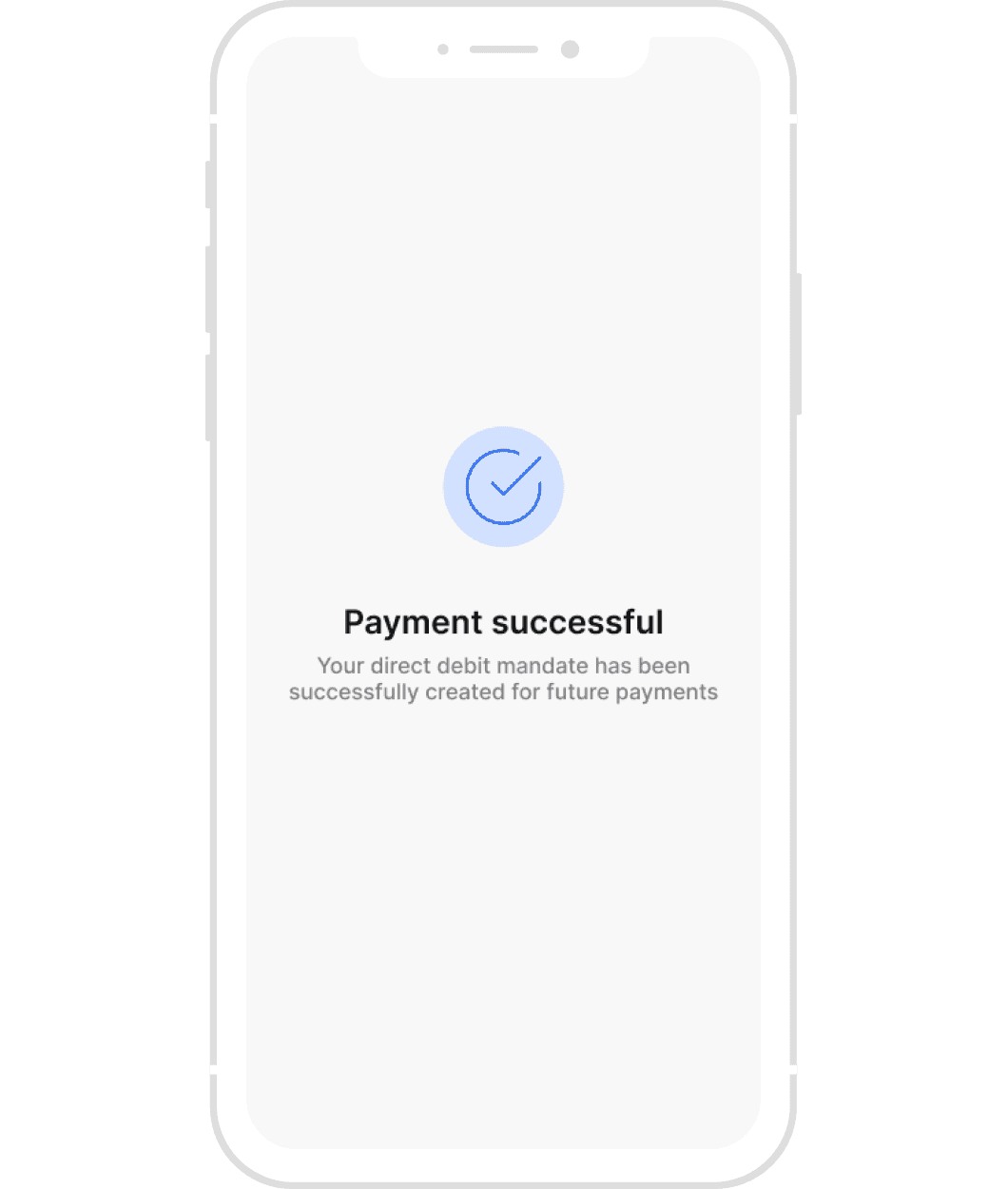

Success!

01.

Select 'Pay by Bank'

Choose Ivy’s "Pay by Bank" in checkout. Trusted local banks create confidence and drive conversion.

02.

Choose your bank

03.

Authorise payment & direct debit mandate

04.

Success!

01.

Select 'Pay by Bank'

Choose Ivy’s "Pay by Bank" in checkout. Trusted local banks create confidence and drive conversion.

02.

Choose your bank

03.

Authorise payment & direct debit mandate

04.

Success!

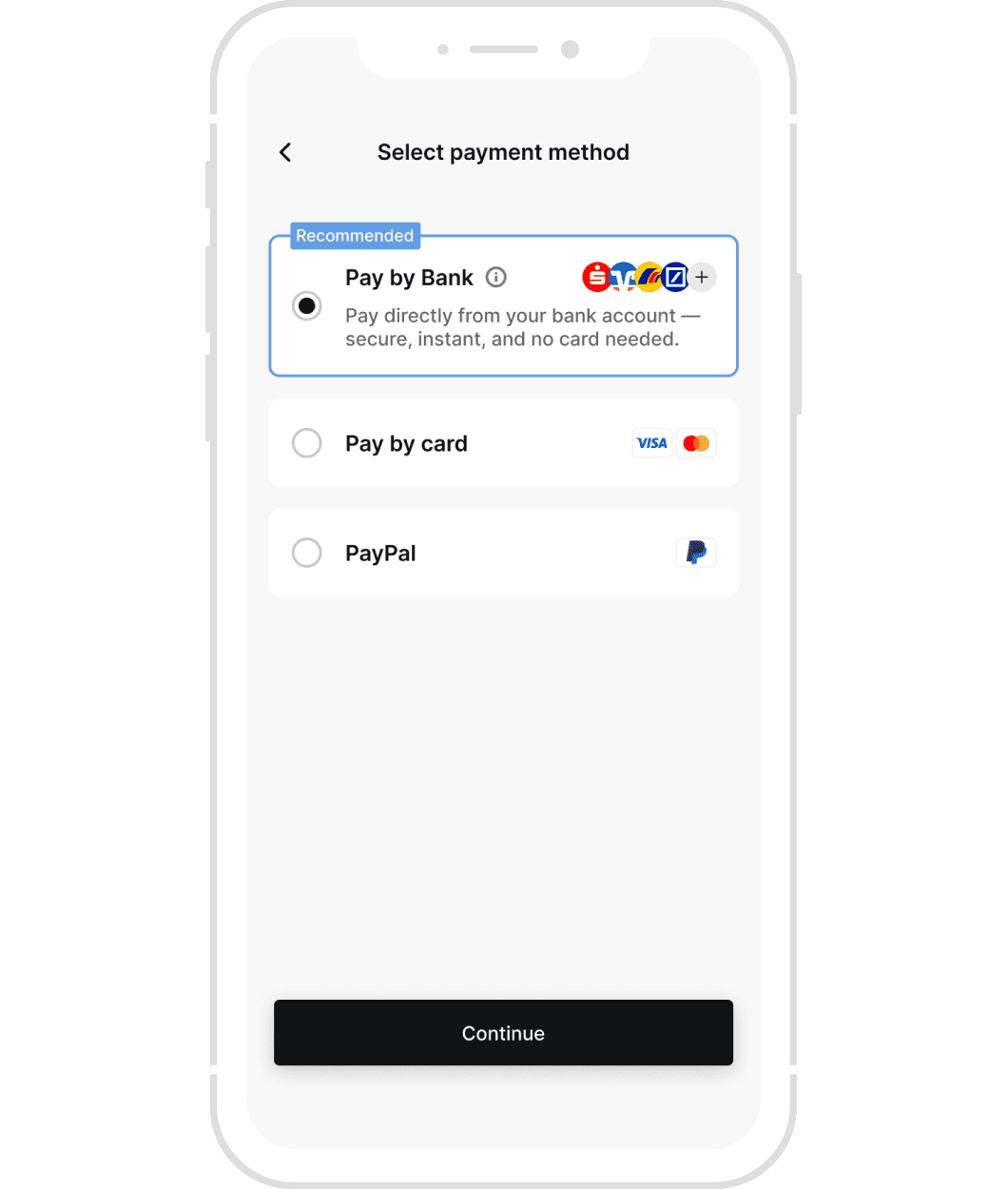

01.

Select 'Pay by Bank'

Choose Ivy’s "Pay by Bank" in checkout. Trusted local banks create confidence and drive conversion.

02.

Choose your bank

03.

Authorise payment & direct debit mandate

04.

Success!

Use cases

Subscription Payments

Ivy's Recurring Payment product offers an automated subscription solution, to ensure an easier and safer Direct Debit experience at better margins. In one simple journey, a secure one-off payment and the Direct Debit mandate for future payments are authorised.

One-Click Payments

Recurring Payments also enables secure one-click payments for returning customers, driving repeat purchases at lower costs. By tokenising the customers' bank account, effortless one-click checkout is possible, increasing conversion and retention.

Use cases

Subscription Payments

Ivy's Recurring Payment product offers an automated subscription solution, to ensure an easier and safer Direct Debit experience at better margins. In one simple journey, a secure one-off payment and the Direct Debit mandate for future payments are authorised.

One-Click Payments

Recurring Payments also enables secure one-click payments for returning customers, driving repeat purchases at lower costs. By tokenising the customers' bank account, effortless one-click checkout is possible, increasing conversion and retention.

Use cases

Subscription Payments

Ivy's Recurring Payment product offers an automated subscription solution, to ensure an easier and safer Direct Debit experience at better margins. In one simple journey, a secure one-off payment and the Direct Debit mandate for future payments are authorised.

One-Click Payments

Recurring Payments also enables secure one-click payments for returning customers, driving repeat purchases at lower costs. By tokenising the customers' bank account, effortless one-click checkout is possible, increasing conversion and retention.

Use cases

Subscription Payments

Ivy's Recurring Payment product offers an automated subscription solution, to ensure an easier and safer Direct Debit experience at better margins. In one simple journey, a secure one-off payment and the Direct Debit mandate for future payments are authorised.

One-Click Payments

Recurring Payments also enables secure one-click payments for returning customers, driving repeat purchases at lower costs. By tokenising the customers' bank account, effortless one-click checkout is possible, increasing conversion and retention.

What our merchants have to say...

“Partnering with Ivy allows us to improve the recurring purchase experience of our customers and boost conversion for Open Banking payments."

Huub Sparnay

CEO of Alphacomm

What our merchants have to say...

“Partnering with Ivy allows us to improve the recurring purchase experience of our customers and boost conversion for Open Banking payments."

Huub Sparnay

CEO of Alphacomm

What our merchants have to say...

“Partnering with Ivy allows us to improve the recurring purchase experience of our customers and boost conversion for Open Banking payments."

Huub Sparnay

CEO of Alphacomm

What our merchants have to say...

“Partnering with Ivy allows us to improve the recurring purchase experience of our customers and boost conversion for Open Banking payments."

Huub Sparnay

CEO of Alphacomm

Built with industry needs in mind…

Grow Sales in eCommerce

Drive conversion by offering recurring payments to all bank account owners, cut transaction costs, and reduce fraud with secure account-to-account payments.

Streamline FinServ Transactions

Facilitate recurring and one-click deposits, reduce fees by bypassing traditional intermediaries, and mitigate fraud with secure account-to-account transactions.

Unlock Instant Fiat Payments

Instantly on- and off-ramp fiat and offer recurring deposits, increase margins by avoiding intermediaries while reducing fraud with secure account-to-account payments.

Built with industry needs in mind…

Grow Sales in eCommerce

Drive conversion by offering recurring payments to all bank account owners, cut transaction costs, and reduce fraud with secure account-to-account payments.

Streamline FinServ Transactions

Facilitate recurring and one-click deposits, reduce fees by bypassing traditional intermediaries, and mitigate fraud with secure account-to-account transactions.

Unlock Instant Fiat Payments

Instantly on- and off-ramp fiat and offer recurring deposits, increase margins by avoiding intermediaries while reducing fraud with secure account-to-account payments.

Built with industry needs in mind…

Grow Sales in eCommerce

Drive conversion by offering recurring payments to all bank account owners, cut transaction costs, and reduce fraud with secure account-to-account payments.

Streamline FinServ Transactions

Facilitate recurring and one-click deposits, reduce fees by bypassing traditional intermediaries, and mitigate fraud with secure account-to-account transactions.

Unlock Instant Fiat Payments

Instantly on- and off-ramp fiat and offer recurring deposits, increase margins by avoiding intermediaries while reducing fraud with secure account-to-account payments.

Built with industry needs in mind…

Grow Sales in eCommerce

Drive conversion by offering recurring payments to all bank account owners, cut transaction costs, and reduce fraud with secure account-to-account payments.

Streamline FinServ Transactions

Facilitate recurring and one-click deposits, reduce fees by bypassing traditional intermediaries, and mitigate fraud with secure account-to-account transactions.

Unlock Instant Fiat Payments

Instantly on- and off-ramp fiat and offer recurring deposits, increase margins by avoiding intermediaries while reducing fraud with secure account-to-account payments.

Built by developers, for developers

Easily integrate with our state-of-the-art API, or with one of our plug-in partners.

Built by developers, for developers

Easily integrate with our state-of-the-art API, or with one of our plug-in partners.

Built by developers, for developers

Easily integrate with our state-of-the-art API, or with one of our plug-in partners.

Built by developers, for developers

Easily integrate with our state-of-the-art API for a cutting-edge recurring payment journey.

Ready to transform your payments?

Connect with an Ivy expert today and discover how we can elevate your business through seamless Open Banking solutions.

Ready to transform your payments?

Connect with an Ivy expert today and discover how we can elevate your business through seamless Open Banking solutions.

Ready to transform your payments?

Connect with an Ivy expert today and discover how we can elevate your business through seamless Open Banking solutions.

Ready to transform your payments?

Connect with an Ivy expert today and discover how we can elevate your business through seamless Open Banking solutions.

Ready to supercharge your recurring payments?

Connect with an Ivy expert today and discover how we can elevate your business through seamless Open Banking solutions for recurring payments.

Copyright © 2024 Ivy GmbH. All rights reserved.

Ivy GmbH may provide payment services through Ivy Pay Oy, which is an Authorized Payment Institution. Ivy Pay Oy's license is granted by the Finnish Financial Supervisory Authority (FIN FSA) with the registration number 3292703-8. Ivy GmbH further partners with regulated financial companies for the issuance of electronic money and payment services. These partners include Modulr Finance B.V., a company registered in the Netherlands with company number 81852401, which is authorized and regulated by the Dutch Central Bank (DNB) as an Electronic Money Institution (Firm Reference Number: R182870) and Swan a simplified joint-stock company (SAS) registered with the Bobigny Trade and Companies Register under number 853 827 103. Your account and related payment services are provided by one or more financially regulated partner. Your funds will be held in one or more segregated accounts and the full value safeguarded in line with the Financial Supervision Act – for more information please see the Modulr or Swan Introduced Client Terms.

Copyright © 2024 Ivy GmbH. All rights reserved.

Ivy GmbH may provide payment services through Ivy Pay Oy, which is an Authorized Payment Institution. Ivy Pay Oy's license is granted by the Finnish Financial Supervisory Authority (FIN FSA) with the registration number 3292703-8. Ivy GmbH further partners with regulated financial companies for the issuance of electronic money and payment services. These partners include Modulr Finance B.V., a company registered in the Netherlands with company number 81852401, which is authorized and regulated by the Dutch Central Bank (DNB) as an Electronic Money Institution (Firm Reference Number: R182870) and Swan a simplified joint-stock company (SAS) registered with the Bobigny Trade and Companies Register under number 853 827 103. Your account and related payment services are provided by one or more financially regulated partner. Your funds will be held in one or more segregated accounts and the full value safeguarded in line with the Financial Supervision Act – for more information please see the Modulr or Swan Introduced Client Terms.

Copyright © 2024 Ivy GmbH. All rights reserved.

Ivy GmbH may provide payment services through Ivy Pay Oy, which is an Authorized Payment Institution. Ivy Pay Oy's license is granted by the Finnish Financial Supervisory Authority (FIN FSA) with the registration number 3292703-8. Ivy GmbH further partners with regulated financial companies for the issuance of electronic money and payment services. These partners include Modulr Finance B.V., a company registered in the Netherlands with company number 81852401, which is authorized and regulated by the Dutch Central Bank (DNB) as an Electronic Money Institution (Firm Reference Number: R182870) and Swan a simplified joint-stock company (SAS) registered with the Bobigny Trade and Companies Register under number 853 827 103. Your account and related payment services are provided by one or more financially regulated partner. Your funds will be held in one or more segregated accounts and the full value safeguarded in line with the Financial Supervision Act – for more information please see the Modulr or Swan Introduced Client Terms.

Copyright © 2024 Ivy GmbH. All rights reserved.

Ivy GmbH may provide payment services through Ivy Pay Oy, which is an Authorized Payment Institution. Ivy Pay Oy's license is granted by the Finnish Financial Supervisory Authority (FIN FSA) with the registration number 3292703-8. Ivy GmbH further partners with regulated financial companies for the issuance of electronic money and payment services. These partners include Modulr Finance B.V., a company registered in the Netherlands with company number 81852401, which is authorized and regulated by the Dutch Central Bank (DNB) as an Electronic Money Institution (Firm Reference Number: R182870) and Swan a simplified joint-stock company (SAS) registered with the Bobigny Trade and Companies Register under number 853 827 103. Your account and related payment services are provided by one or more financially regulated partner. Your funds will be held in one or more segregated accounts and the full value safeguarded in line with the Financial Supervision Act – for more information please see the Modulr or Swan Introduced Client Terms.